Comprehensive Market Visualization

One Intelligent View

The only platform that combines real-time GEX visualization, options flow, and multi-market overlay in one powerful interface. Built for professional futures traders.

Start Free Trial3-day trial · No credit card required

From login to actionable insights in 60 seconds

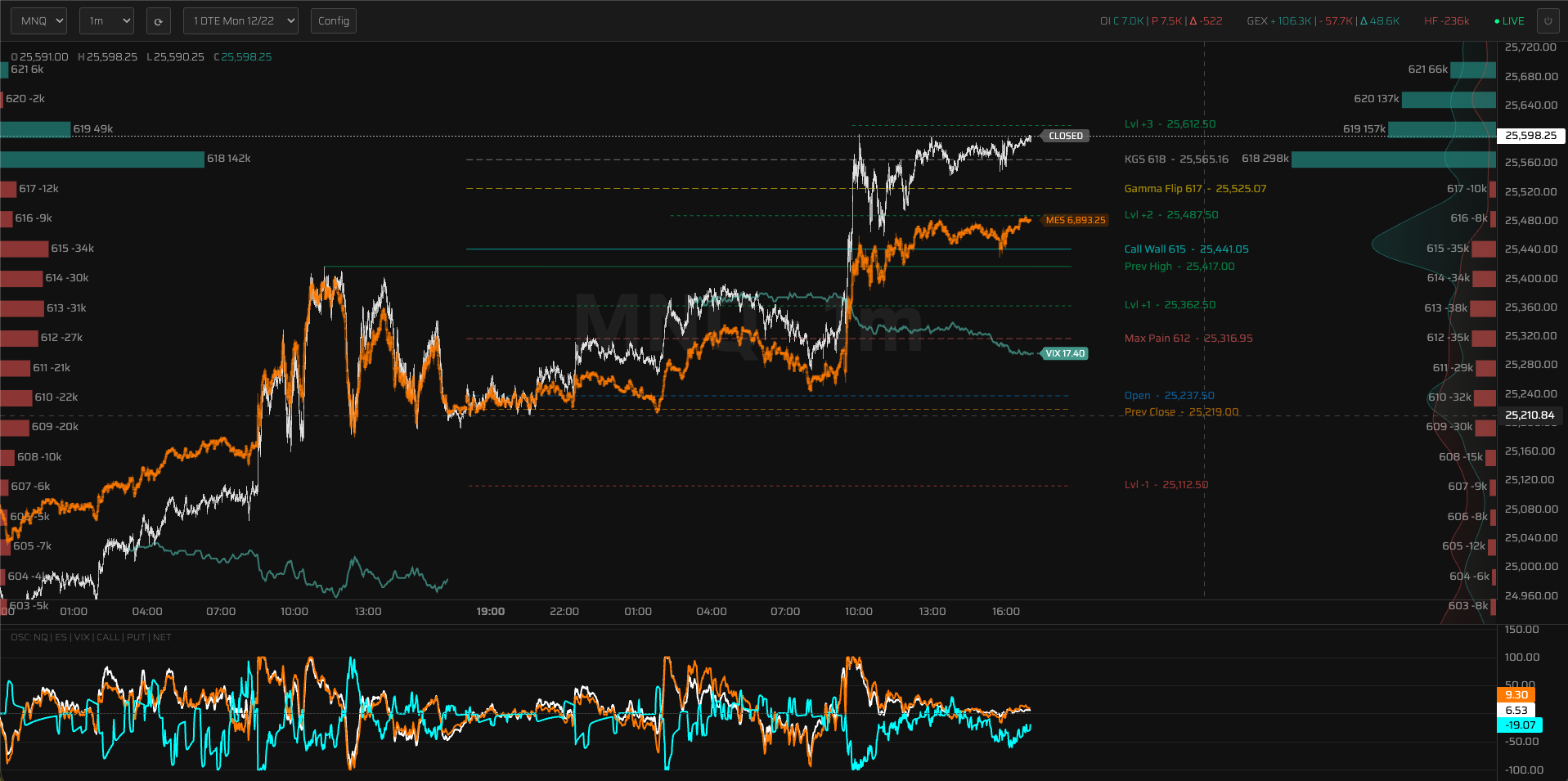

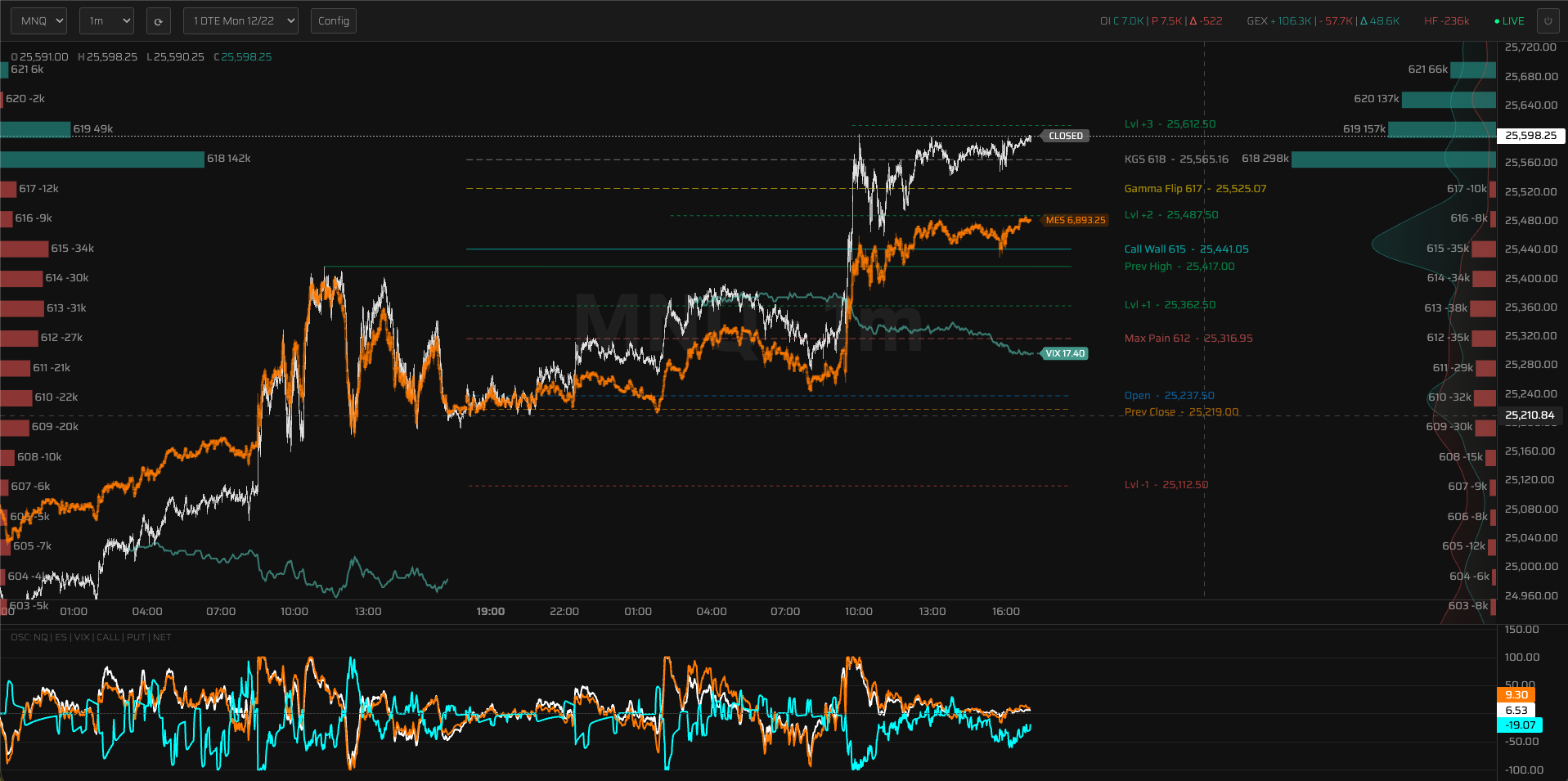

Prices don't move randomly. When institutions open large options positions on SPY and QQQ, market makers must hedge their exposure by trading futures contracts like ES and NQ. This hedging activity creates predictable price behavior around key strike levels.

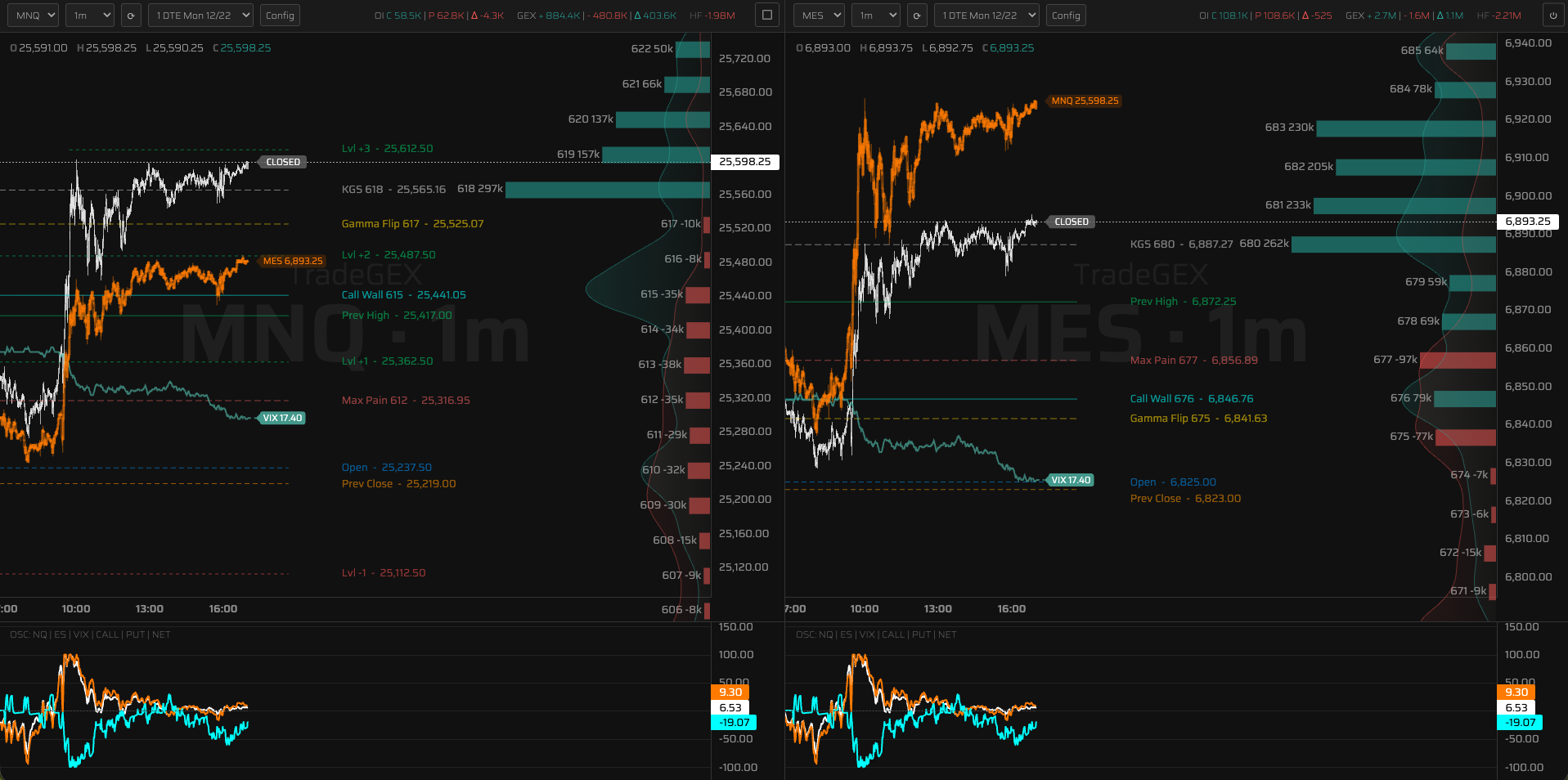

TradeGEX visualizes the relationship in real time. By analyzing options flow data and mapping it directly onto futures charts, you can see where institutional hedging pressure is concentrated and how it influences price movement on MNQ, MES, NQ, and ES.

Choose your preferred symbol (MNQ, MES, NQ, ES) and access real-time price action with integrated GEX overlay.

Identify critical price levels: Call Wall, Put Wall, Gamma Flip, and Max Pain, where dealer hedging activity concentrates.

Utilize Hedge Flow and multi-market oscillators to validate entries and exits with institutional-level data.

Professional analytics that reveal the structural forces driving price movement

High gamma strikes function as price attractors. Visualize where gamma concentration occurs to anticipate price pinning behavior.

Monitor Gamma Flip levels where market dynamics shift. Our proprietary HF indicator tracks institutional hedging flow in real-time.

Put Wall and Call Wall represent levels where market makers actively defend positions, providing structurally significant price boundaries.

Our integrated oscillator combines NQ, ES, VIX, and options flow data into a unified signal for comprehensive market analysis.

Monitor MNQ and MES concurrently. Identify divergences, confirm setups, and enhance decision-making through cross-market correlation analysis.

Experience professional-grade market analysis

Start Free TrialFull platform access. Cancel anytime.

No credit card required

Access the institutional-grade tools professional traders rely on.

Start Your Free Trial